In Melbourne's dynamic financial landscape, understanding and managing leverage risk in trading is crucial for investors seeking wealth within. By balancing strategic risk with careful management, Melburnians can navigate the market's potential for substantial returns while minimizing losses. This involves diversifying investments, setting goals, assessing risk tolerance, and staying informed about market trends and news. Successful cases across sectors demonstrate how leveraging risk can transform underutilized areas and drive economic growth, highlighting its power in Melbourne's robust financial scene.

Discover how to harness the power of leverage risk in trading from a Melbourne perspective. This article explores the dynamic financial landscape of Australia’s cultural hub and uncovers strategies for unlocking significant wealth potential. We delve into navigating risky opportunities, providing insights on successful risk management tailored to Melbourne markets. Through real-world case studies, learn from exemplary examples of individuals who have mastered leverage risk in trading, showcasing the potential for substantial gains within these dynamic financial environments.

- Understanding Leverage Risk in Trading: A Melbourne Perspective

- Unlocking Wealth Potential: Navigating Risky Opportunities

- Strategies for Successful Risk Management in Melbourne Markets

- Case Studies: Real-World Examples of Leverage Risk Success in Melbourne's Financial Scene

Understanding Leverage Risk in Trading: A Melbourne Perspective

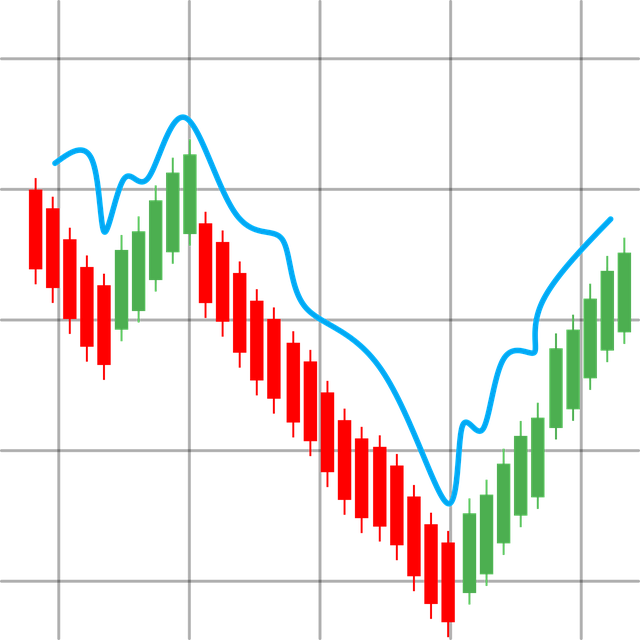

In the dynamic financial landscape of Melbourne, understanding leverage risk in trading is paramount for both seasoned investors and newcomers alike. Leverage risk refers to the potential for significant gains or losses that can arise from utilizing borrowed funds to increase investment exposure. While it offers the opportunity to amplify wealth within a short period, it also carries the risk of substantial losses if market conditions move against the investor. Melbourne’s bustling financial hub is characterized by its diverse range of trading opportunities, making it crucial for traders to grasp how leverage can impact their strategies and overall wealth.

With a keen awareness of leverage risk, Melburnians can navigate the city’s vibrant financial tapestry more effectively. This involves careful assessment of risk tolerance, investment goals, and market dynamics. By balancing leverage with prudent risk management techniques, investors can harness the potential for substantial returns while mitigating the threat of catastrophic losses. Such an approach ensures that wealth creation remains not just a possibility but a tangible goal within Melbourne’s ever-evolving financial crucible.

Unlocking Wealth Potential: Navigating Risky Opportunities

In Melbourne’s dynamic market, unlocking wealth potential often lies in navigating risky opportunities with strategic precision. Leverage risk in trading isn’t about reckless betting; it’s a calculated approach to amplify returns. By embracing volatility and understanding market dynamics, investors can tap into hidden gems and capitalize on emerging trends. This requires a keen eye for identifying high-growth sectors and undervalued assets, enabling savvy traders to secure substantial gains.

Wealth within Melbourne’s economic landscape is not solely reserved for the risk-averse; it beckons those who dare to venture beyond conventional boundaries. Embracing leverage risk allows investors to diversify their portfolios, mitigate potential losses through careful risk management, and seize control of their financial future. With a well-informed strategy, navigating these risky opportunities can be a game-changer, transforming cautious savings into substantial wealth.

Strategies for Successful Risk Management in Melbourne Markets

In the dynamic market of Melbourne, effective risk management is key to unlocking significant gains and fostering wealth creation. Successful traders here leverage risk in trading by employing strategic approaches that balance caution with opportunity. Diversification is a powerful tool; spreading investments across various sectors and assets reduces the impact of any single loss. Additionally, setting clear objectives and defining risk tolerance levels help traders make informed decisions, ensuring they take calculated risks aligned with their financial goals.

Technical analysis plays a pivotal role in Melbourne’s markets, providing insights into historical price trends and patterns. Traders use indicators and charts to identify entry and exit points, enabling them to maximize profits while minimizing drawdowns. Furthermore, staying abreast of market news and economic indicators is crucial, as these factors can significantly influence asset prices, presenting both risks and opportunities for strategic leveraging within the Melbourne markets.

Case Studies: Real-World Examples of Leverage Risk Success in Melbourne's Financial Scene

In the dynamic financial landscape of Melbourne, leveraging risk in trading has proven to be a game-changer for numerous investors and businesses. Case studies across various sectors highlight successful strategies that have transformed potential risks into significant opportunities, fostering wealth within communities and driving economic growth. For instance, property developers have cleverly utilized leveraged risk to embark on ambitious projects, transforming underutilized areas into vibrant, bustling hubs that attract both residents and investors alike. These developments not only enhance the local tapestry but also generate substantial returns, demonstrating the power of strategic risk assessment.

Another compelling example involves start-up tech companies in Melbourne’s thriving silicon valley. By employing creative leverage risk tactics, these young businesses have gained a competitive edge, attracting significant investments and global attention. Their success stories are a testament to the city’s ability to nurture innovative ideas and turn them into reality, often resulting in substantial wealth creation for early investors. These real-world examples serve as inspiration for aspiring entrepreneurs and financial strategists alike, illustrating that with the right approach, leveraging risk can unlock unprecedented opportunities within Melbourne’s robust financial scene.

Melbourne’s dynamic financial landscape presents unique opportunities for leveraging risk to unlock substantial wealth. By understanding local market dynamics and implementing effective risk management strategies, traders can navigate the challenges of leverage risk in trading. The case studies highlighted demonstrate that successful risk assessment and strategic decision-making can lead to remarkable gains. Embracing these principles equips individuals with the tools to harness Melbourne’s financial opportunities and achieve their wealth goals.