In Melbourne's dynamic financial landscape, understanding leverage risk in trading is key for investors aiming to generate wealth ("wealth within"). Balancing market volatility with strategic tools like stop-loss orders and diversification allows traders to harness leverage's benefits while minimizing losses. The city's diverse economy, robust infrastructure, and innovative policies create numerous opportunities across sectors like tech, property, and manufacturing. By staying informed and employing tailored risk management strategies, investors can navigate Melbourne's market effectively and achieve substantial returns.

Unleash your financial potential in Melbourne’s dynamic market. This guide explores how to discover and capitalize on leverage risk opportunities, unlocking wealth creation prospects unique to this vibrant city. From understanding the intricacies of leverage risk in trading with a Melbourne lens, to identifying market trends driving wealth, we navigate the economic landscape’s risks and rewards. Learn effective risk management strategies and gain insights from real-life case studies showcasing successful leverage and wealth generation. Access essential tools and resources to empower your financial journey.

- Understanding Leverage Risk in Trading: A Melbourne Perspective

- Identifying Wealth Creation Opportunities in a Dynamic Market

- Navigating Melbourne's Economic Landscape: Risks and Rewards

- Strategies for Effective Risk Management in Trading Activities

- Case Studies: Successful Leverage and Wealth Generation in Melbourne

- Tools and Resources to Maximize Your Financial Potential

Understanding Leverage Risk in Trading: A Melbourne Perspective

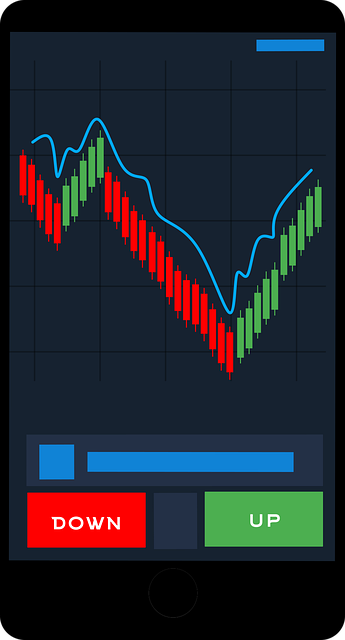

In the dynamic financial landscape of Melbourne, understanding leverage risk in trading is paramount for both seasoned investors and newcomers alike. Leverage, a powerful tool that allows traders to amplify potential returns, comes with inherent risks. It offers the opportunity to multiply wealth within short periods but can also lead to significant losses if not managed prudently. Melbourne’s bustling financial hub, known for its diverse investment opportunities, presents unique scenarios for navigating leverage risk.

Traders in this vibrant city must be cognizant of market volatility and the impact it can have on leveraged positions. With various assets, from stocks to property, offering leverage options, investors should employ strategic risk management techniques. This involves setting clear stop-loss orders, diversifying portfolios, and staying informed about economic indicators influencing Melbourne’s financial markets. By embracing a balanced approach, Melbourne’s traders can effectively harness the benefits of leverage while mitigating potential pitfalls, thereby fostering wealth creation in a dynamic environment.

Identifying Wealth Creation Opportunities in a Dynamic Market

Melbourne’s dynamic market presents a unique landscape for aspiring investors seeking to unlock wealth creation opportunities. By understanding the intricate interplay between leverage and risk in trading, individuals can navigate this vibrant financial arena effectively. Leverage risk in trading involves strategically allocating resources to maximize potential returns while mitigating losses. It’s about recognizing that with greater reward comes the possibility of higher risk.

In a market as diverse as Melbourne’s, identifying wealth within requires a keen eye for trends and a proactive approach. The city’s economic pulse is influenced by various sectors, from real estate and finance to technology and culture. By staying informed and adapting strategies accordingly, investors can seize moments of growth. Whether through property investments, entrepreneurial ventures, or innovative startups, Melbourne offers a myriad of avenues to build and protect wealth, ensuring those who embrace the dynamic nature of the market stand to gain significantly.

Navigating Melbourne's Economic Landscape: Risks and Rewards

Navigating Melbourne’s Economic Landscape presents a unique blend of risks and rewards for savvy investors looking to leverage risk in trading. The city’s diverse economy, robust infrastructure, and thriving financial sector create numerous opportunities to generate wealth within various sectors, from technology and property to tourism and manufacturing. However, understanding the local market dynamics is paramount; economic fluctuations, regulatory changes, and global trends can significantly impact investment prospects.

Melbourne’s resilience and adaptability have been on full display in recent years, with its economy quickly recovering from setbacks and continuing to grow at a steady pace. This stability, coupled with innovative policies aimed at fostering entrepreneurship and attracting foreign investment, presents a compelling backdrop for those seeking to navigate the city’s economic landscape astutely. Leverage risk in trading thoughtfully by capitalizing on Melbourne’s strengths while remaining agile enough to mitigate potential risks can lead to substantial wealth creation within this dynamic environment.

Strategies for Effective Risk Management in Trading Activities

Navigating Melbourne’s financial landscape offers unique opportunities for traders seeking to amplify their returns through strategic use of leverage risk. However, it’s crucial to employ robust risk management strategies to protect wealth within volatile markets. Diversification stands as a cornerstone, spreading investments across various assets to mitigate single-point failures.

Traders can also leverage stop-loss orders to automatically exit positions if they decline by a predetermined amount, limiting downside risk. Risk-reward ratios should be carefully considered, ensuring potential gains outweigh the risks. Additionally, staying informed about market trends and economic indicators enables traders to make more informed decisions, further refining their leverage risk strategies in Melbourne’s dynamic financial environment.

Case Studies: Successful Leverage and Wealth Generation in Melbourne

In the dynamic market of Melbourne, case studies illustrate how strategic leveraging of risk can translate into significant wealth generation. Local entrepreneurs and investors have successfully navigated the city’s unique economic landscape by adopting innovative strategies that maximize returns while managing risks effectively. One prominent example involves a tech startup that utilized high-growth sectors to its advantage. By investing early in emerging technologies with strong potential, the company was able to secure substantial returns when these industries took off. This approach not only highlights the potential for significant wealth creation but also underscores the importance of identifying and capitalizing on Melbourne’s burgeoning sectors.

Another inspiring story involves a real estate investor who mastered the art of leverage risk trading in Australia’s property market. Through careful analysis and strategic financing, they acquired undervalued properties during economic downturns. As the Melbourne property market rebounded, their investments appreciated dramatically, yielding substantial profits. This case study demonstrates how a deep understanding of market dynamics and timely intervention can turn challenges into opportunities for wealth within.

Tools and Resources to Maximize Your Financial Potential

In Melbourne’s dynamic financial landscape, leveraging risk in trading can be a game-changer for aspiring investors. The city offers an array of tools and resources designed to maximize your financial potential. From robust online trading platforms that provide real-time market data to specialized investment seminars, these assets equip individuals with the knowledge and skills to navigate the complexities of global markets.

By harnessing digital infrastructure, such as high-speed internet connectivity, Melburnians can execute trades swiftly and efficiently. Additionally, local financial regulators and industry bodies offer guidance on risk management strategies, ensuring investors have access to expert advice tailored to Australia’s unique economic environment. This combination of technological advancement and regulatory support creates an ideal environment for cultivating wealth within the city’s thriving financial ecosystem.

Melbourne’s dynamic economic landscape presents a unique blend of risks and rewards, especially for traders seeking to leverage their financial strategies. By understanding the local market nuances and adopting effective risk management techniques, individuals can unlock significant wealth creation opportunities. This article has provided an extensive guide on navigating Melbourne’s economic scene, from recognizing leverage risk in trading to exploring valuable tools and resources. Through practical case studies, readers gain insights into successful wealth generation strategies, empowering them to make informed decisions and maximize their financial potential within this vibrant city.