Trading with leverage is a powerful tool for Sydney investors to enhance wealth within financial markets by amplifying buying power. While it allows for faster capital growth through borrowing from brokers, it also increases both gains and losses, requiring a delicate balance of risk and reward. When used judiciously, this strategy enables traders to navigate the dynamic market landscape effectively and achieve substantial wealth within a shorter timeframe, with successful case studies showcasing its potential.

“Sydney, a global financial hub, offers traders an unparalleled opportunity to unlock immense potential wealth through trading with leverage. This article delves into the strategies and insights that drive success in leveraged trading, exploring its fundamentals, safe usage practices, and Sydney’s unique advantages. From understanding market dynamics to real-world examples, discover how leveraging your investments can accelerate wealth creation. Learn practical strategies tailored for Sydney traders aiming to maximize returns while managing risk effectively.”

- Understanding Trading with Leverage: Unlocking Potential Wealth

- The Basics of Leverage in Financial Markets

- Strategies for Effective and Safe Leverage Usage

- Sydney's Unique Advantages for Leverage Traders

- Building Wealth: Real-World Examples and Case Studies

Understanding Trading with Leverage: Unlocking Potential Wealth

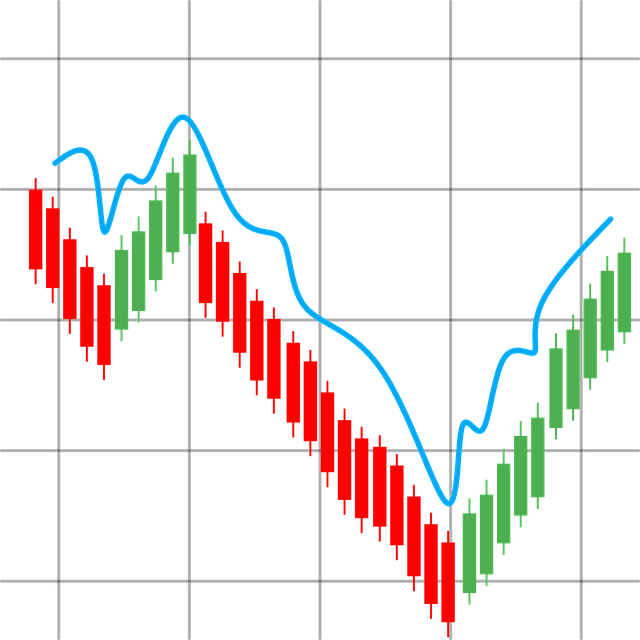

Trading with leverage is a powerful tool that can significantly enhance an investor’s potential for wealth within the financial markets. It involves borrowing funds to increase buying power, allowing traders to control larger positions than they could with their initial capital alone. This strategy leverages both gains and losses; while it amplifies profits, it also magnifies risks.

Understanding how leverage works is crucial. Every additional unit of borrowed money represents the possibility of greater returns but comes with a corresponding risk. Traders must manage this balance carefully, as excessive leverage can lead to substantial losses if markets move against their positions. However, when used judiciously, trading with leverage provides an opportunity to capture market movements and potentially achieve substantial wealth within a shorter timeframe.

The Basics of Leverage in Financial Markets

Leverage is a powerful tool in financial markets that allows traders to increase their buying or selling power beyond their initial investment. It essentially amplifies potential gains, enabling Sydney-based investors to maximize wealth within the market. By borrowing funds from brokers, traders can control a larger position size in assets like stocks, commodities, or currencies. This strategy is particularly appealing for those seeking to grow their capital faster.

However, trading with leverage also comes with risks. While it magnifies gains, it can also amplify losses. If the market moves against the trader’s position, borrowed funds may lead to significant financial exposure. It’s crucial to understand margin requirements and risk management techniques when leveraging in Sydney’s dynamic financial landscape to ensure sustainable wealth creation rather than potential ruin.

Strategies for Effective and Safe Leverage Usage

Leverage in trading can be a double-edged sword, offering both significant gains and potential losses. To effectively and safely navigate this aspect, traders in Sydney or anywhere else must adopt strategic practices. Firstly, defining clear risk management parameters is crucial. This involves setting stop-loss orders to limit downside exposure and establishing a well-balanced position sizing strategy that aligns with your risk tolerance. Diversification across various assets can also mitigate risks, ensuring that not all eggs are in one basket.

Additionally, staying informed about market trends and news is essential. Leverage should be used judiciously based on sound analytical insights. Traders should aim to identify and capitalize on trends rather than trying to time the market. Regularly reviewing and adjusting strategies according to evolving conditions will help maintain a healthy relationship with leverage, fostering wealth within rather than succumbing to potential pitfalls.

Sydney's Unique Advantages for Leverage Traders

Sydney offers a unique set of advantages that make it an attractive destination for traders looking to maximise their potential through trading with leverage. The city’s dynamic and well-regulated financial landscape provides a robust environment for executing complex trading strategies. With access to a diverse range of global markets, Sydney-based traders can tap into opportunities across various asset classes, from equities and commodities to currencies and derivatives.

One key advantage is the presence of major financial institutions and a sophisticated investment community. This concentration of resources enables traders to gain early access to market insights, innovative trading tools, and competitive leverage options. Moreover, Sydney’s robust regulatory framework ensures transparency and investor protection, fostering an environment where wealth creation through strategic leveraging can thrive while maintaining integrity in the financial markets.

Building Wealth: Real-World Examples and Case Studies

Sydney, a bustling metropolis known for its vibrant financial sector, serves as a prime example of how strategic leverage in trading can lead to significant wealth accumulation. Through meticulous research and innovative approaches, investors have successfully navigated the markets, turning initial capital into substantial gains. One notable case study involves a young entrepreneur who, with a keen understanding of economic trends and a bold strategy using trading with leverage, managed to quadruple his investment within a year. This remarkable transformation is not an isolated incident; numerous similar success stories can be found across various sectors, from tech startups to traditional finance.

These real-world examples illustrate the power of leveraging trading insights and strategies. By employing well-researched techniques, investors can mitigate risks while amplifying potential returns. For instance, a case study focusing on a mid-sized company’s stock demonstrated how strategic borrowing and derivatives usage allowed them to capitalize on market fluctuations, leading to a 30% increase in share value over six months. Such successes not only highlight the importance of staying informed but also encourage aspiring investors to explore innovative methods within the realm of trading with leverage to achieve wealth within their reach.

Sydney offers a dynamic environment for traders seeking to unlock their potential through trading with leverage. By understanding the fundamentals of leverage, implementing safe strategies, and leveraging Sydney’s unique advantages, individuals can navigate financial markets effectively. The case studies presented demonstrate that, with careful consideration, trading with leverage can lead to significant wealth within reach for those willing to learn and adapt.