Trading with leverage in Sydney's dynamic markets offers traders access to larger positions and higher profits, but it significantly increases risk. Balancing exposure and risk through optimal asset-to-debt ratios, position size adjustments, automated tools, and margin calculators empowers traders to effectively manage leverage complexities. Success stories of local investors like Mark and Sarah demonstrate the potential for strategic leverage in achieving substantial returns while maintaining financial stability.

Sydney traders looking to amplify their returns should explore advanced leverage strategies. This article demystifies ‘trading with leverage’, a powerful tool that can significantly boost profits but also carries substantial risks. We delve into understanding leverage, exploring tactical approaches, optimizing margin usage, and effective risk management. By examining real-world case studies, Sydney’s traders can navigate the complexities of high-leverage trading, unlocking potential while preserving capital in dynamic markets.

- Understanding Trading Leverage: Unlocking Potential Risks and Rewards

- Advanced Leverage Strategies: A Deep Dive for Sydney Traders

- Optimizing Margin Usage: Key Tactics to Enhance Profitability

- Managing Risk: Safeguarding Your Portfolio in Volatile Markets

- Case Studies: Success Stories of High-Leverage Trading in Sydney

Understanding Trading Leverage: Unlocking Potential Risks and Rewards

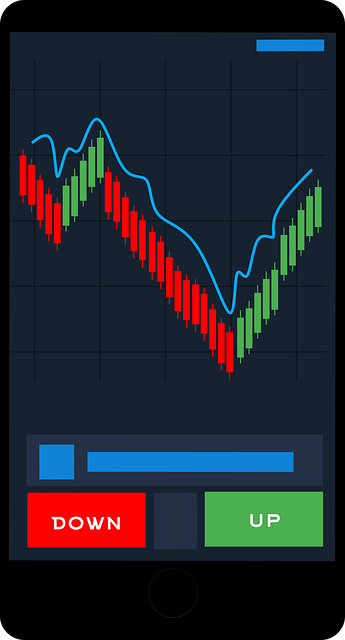

Leverage is a powerful tool in the trader’s arsenal, allowing them to amplify gains from successful trades. However, it also multiplies potential losses if the market moves against them. Trading with leverage means borrowing funds from a broker to increase buying power, enabling Sydney traders to access larger positions than their capital alone would permit. This strategy can unlock significant profits, especially in volatile markets.

While leveraging offers exciting opportunities, it’s crucial to grasp its complexities. Improper use can lead to substantial financial losses. Traders should set clear stop-loss orders to limit downside risk and carefully manage position sizes relative to their account balance. Understanding the impact of leverage on both risk and reward is essential for informed decision-making in Sydney’s dynamic trading environment.

Advanced Leverage Strategies: A Deep Dive for Sydney Traders

In the dynamic world of Sydney’s financial markets, traders constantly seek innovative strategies to enhance their returns. Advanced leverage strategies offer a compelling avenue for growth, but they also come with heightened risks. This deep dive explores how Sydney traders can effectively navigate these complex strategies, leveraging tools like margin trading and short selling to maximize profits. By understanding the intricate dynamics of trading with leverage, investors can make informed decisions, ensuring they harness its power while mitigating potential losses.

Traders in Sydney, known for their savvy approach to markets, can benefit from a strategic blend of technical analysis, risk management techniques, and a keen awareness of market trends. Advanced leverage strategies allow them to amplify gains during favorable conditions but demand meticulous monitoring and discipline. With the right knowledge and tools, Sydney traders can confidently explore these methods, opening doors to significant opportunities in an ever-evolving financial landscape.

Optimizing Margin Usage: Key Tactics to Enhance Profitability

In Sydney’s dynamic trading landscape, understanding how to optimize margin usage is a strategic advantage for traders looking to enhance their profitability when trading with leverage. Effective margin management involves a delicate balance between maximizing exposure and minimizing risk. Traders should employ key tactics such as maintaining a healthy asset-to-debt ratio, regularly reviewing and adjusting position sizes based on market conditions, and utilizing automated tools or brokers’ margin calculators to ensure optimal utilization.

By adopting these practices, Sydney traders can navigate the complexities of trading with leverage more confidently. Optimizing margin usage allows for increased capital efficiency, enabling traders to take larger positions without compromising their overall financial stability. This strategic approach not only amplifies potential gains but also helps mitigate risks associated with concentrated bets, ultimately contributing to a more robust and sustainable trading performance.

Managing Risk: Safeguarding Your Portfolio in Volatile Markets

In volatile markets, managing risk is paramount for Sydney traders employing advanced leverage strategies. Trading with leverage can amplify both gains and losses, making it crucial to implement robust risk management practices. Diversifying your portfolio across various asset classes and sectors can help mitigate concentration risk, ensuring that a decline in one market segment doesn’t significantly impact your overall performance. Additionally, setting stop-loss orders is an effective way to limit potential losses by automatically selling assets when they reach a predetermined price, preventing further damage during market downturns.

Sydney traders should also consider the impact of leverage on their risk tolerance and adjust positions accordingly. Regularly reviewing and rebalancing your portfolio can help maintain a healthy risk-reward ratio. Staying informed about market trends and economic indicators allows for proactive risk management, enabling traders to make timely adjustments to their strategies. By prioritizing risk mitigation, Sydney traders using advanced leverage techniques can navigate volatile markets with confidence, preserving their capital and enhancing long-term profitability.

Case Studies: Success Stories of High-Leverage Trading in Sydney

In the competitive world of Sydney’s financial markets, understanding and effectively utilizing advanced leverage strategies can be a game-changer for traders. Numerous success stories highlight how strategic use of trading with leverage has led to substantial gains for local investors. For instance, consider the case of Mark, a seasoned trader who applied leveraged ETFs (Exchange-Traded Funds) to diversify his portfolio. By employing this tactic, he was able to capitalize on market fluctuations, achieving an average annual return of 15% over three years.

Another inspiring story is that of Sarah, a young entrepreneur who utilized margin trading to back her innovative startup ideas. Her strategy involved careful risk management and leveraging short-term trades during market volatility. This approach allowed her to secure funding for her ventures while navigating the high-stakes environment. As a result, her diversified portfolio grew exponentially, attracting significant attention from investors eager to replicate her success in trading with leverage.

Sydney traders can significantly enhance their trading experience and potential profits by mastering advanced leverage strategies. Throughout this article, we’ve explored the intricacies of understanding trading leverage, delving into various deep tactics for maximizing profitability while ensuring robust risk management. By optimizing margin usage and learning from real-world case studies, traders can navigate the dynamic market landscape with confidence. Trading with leverage is a powerful tool, but it requires careful navigation; armed with the right knowledge, Sydney’s trading community can unlock new levels of success in this competitive financial arena.