Stop loss orders are essential risk management tools for newcomers to trading, enabling them to protect their wealth within volatile markets by automatically selling assets at predetermined prices, thus limiting potential losses and safeguarding investments from significant declines. Understanding risk tolerance, defining clear entry/exit points, and regularly reviewing/adjusting stop losses are crucial for maximizing opportunities to unlock wealth within the market.

“Unraveling the complexities of trading is essential for beginners aiming to maximize their wealth potential. This comprehensive guide, ‘Stop Loss Simplified,’ serves as your navigation tool through the financial markets. We’ll start by understanding basic trading concepts, then delve into defining and setting stop loss orders, a powerful risk management tool.

Learn about crucial factors to consider, common mistakes to avoid, and strategic techniques to utilize stop loss for optimal wealth creation.”

- Understanding Basic Trading Concepts

- Defining Stop Loss and Its Purpose

- Setting a Stop Loss Order: Step-by-Step

- Factors to Consider When Placing a Stop

- Common Mistakes to Avoid with Stop Loss

- Maximizing Wealth Potential with Strategic Stop Loss

Understanding Basic Trading Concepts

For beginners navigating the world of trading, understanding basic concepts is crucial for building a solid foundation and unlocking the potential for wealth within the market. One essential term to grasp is ‘stop loss’. This strategy involves setting a predetermined price at which an investor decides to sell their asset if it drops below a certain level. By doing so, they limit potential losses, ensuring that even if the trade goes against them, the downside is capped.

It’s a risk management tool that allows traders to protect their capital and maintain a disciplined approach. When you employ a stop loss order, you’re not just hoping for the best; instead, you’re actively managing risk. This concept is pivotal in the trading journey, as it encourages a thoughtful, strategic mindset rather than one driven solely by emotion or fear.

Defining Stop Loss and Its Purpose

Stop loss is a fundamental concept in trading, designed to protect your investment and help you manage risk effectively. At its core, it’s a pre-set order to sell an asset, like stocks or cryptocurrencies, once it reaches a specific price. This simple yet powerful tool has one primary purpose: to limit potential losses and safeguard your wealth within the market.

Imagine you invest in a stock, but the market takes an unexpected turn, causing its price to drop rapidly. Without a stop loss order in place, you might be left with significant financial losses. However, when you set a stop loss at a predetermined price, your trading platform will automatically execute a sell order once that price is reached, preventing further decline and helping you secure what’s left of your investment.

Setting a Stop Loss Order: Step-by-Step

Setting a stop loss order is a crucial step in managing your investments and protecting your potential wealth within the market. Here’s a simple, step-by-step guide for beginners:

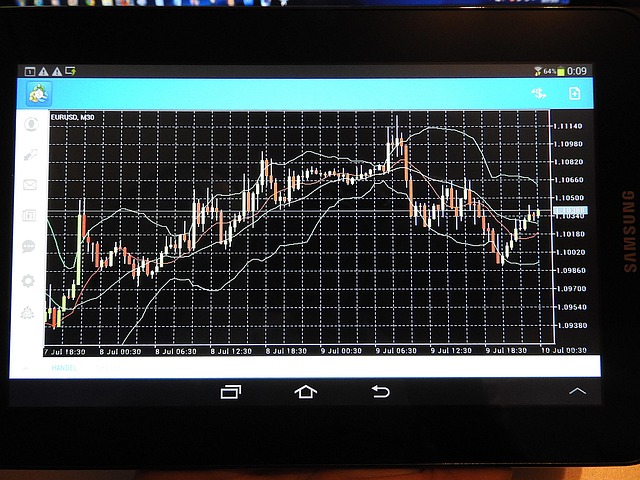

1. Determine Your Target: First, decide on the price level at which you want to exit your position if the market moves against you. This could be based on a specific percentage drop or a fixed amount per share. For instance, you might choose to sell if the stock price falls below its purchase price by 5%.

2. Place the Order: Once you’ve established your target, contact your broker or utilize their online platform to place a stop loss order. Clearly communicate your instructions: “Set a stop loss order at [insert price].” Make sure to specify the security and the exact price point where you want the order triggered.

Factors to Consider When Placing a Stop

When placing a stop loss, beginners should consider several key factors to maximize their potential for wealth within the market. First, understanding your risk tolerance is crucial; how much financial loss are you comfortable with? This personal assessment guides the placement of your stop point, ensuring that even if the trade goes against you, the damage remains manageable.

Next, identifying a clear entry point and determining where you’d like to exit the trade are essential. A well-defined strategy helps establish a sensible stop level. For instance, if you buy a stock at $50 per share, setting a stop loss at $45 could be appropriate, given your risk tolerance and desired profit margin. These considerations empower traders to make informed decisions, fostering a disciplined approach to navigating financial markets and potentially unlocking wealth within.

Common Mistakes to Avoid with Stop Loss

Many traders, especially beginners, often make mistakes when setting stop loss orders, which can hinder their journey towards achieving wealth within the market. A common oversight is not placing a stop loss at an appropriate level. Traders might be emotional and hold on to losing positions too long, hoping for a turnaround, which can lead to significant losses.

Another mistake is not reviewing and adjusting stop-loss orders regularly. Market conditions change swiftly, and what was a safe distance yesterday might become a dangerous position today. Traders should aim to protect their wealth within the market by staying vigilant, monitoring their trades, and making necessary adjustments to their stop loss strategies.

Maximizing Wealth Potential with Strategic Stop Loss

Maximizing Wealth Potential with Strategic Stop Loss

In the quest for wealth within the financial markets, understanding stop loss orders is paramount. These tools aren’t just about risk management; they’re a strategic element to enhance your overall investment strategy and maximize wealth potential. By setting specific price levels where an order automatically sells an asset, you can secure gains while limiting potential losses. This proactive approach ensures that even if the market moves against you, you’ve locked in profits at a predetermined point.

Strategic stop loss orders allow investors to participate in the growth of their investments without constantly monitoring the markets. They provide a safety net, enabling individuals to take calculated risks and seize opportunities for substantial returns. By combining strategic stop losses with sound investment principles, beginners can navigate the financial landscape with confidence, aiming to secure and grow their wealth over time.

Understanding and utilizing stop loss orders effectively is a crucial step towards maximizing your wealth potential in trading. By setting clear boundaries, you can navigate the markets with confidence and minimize potential losses. Remember, a well-placed stop loss isn’t just about protecting against downside risks; it’s a strategic tool to help you achieve long-term success within the financial markets.