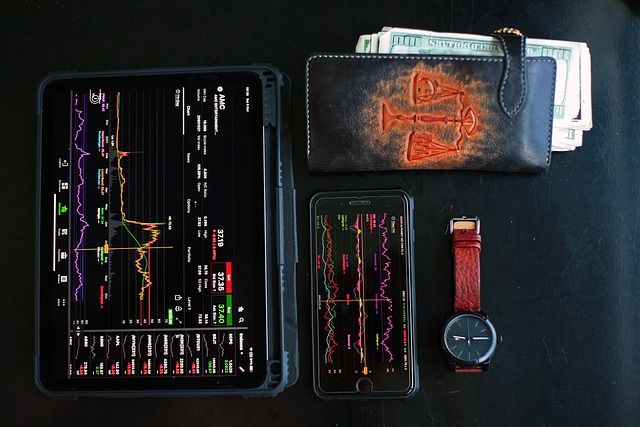

Leveraged trading, a strategy common in financial markets, allows investors to control larger positions with minimal capital by borrowing funds. It offers the potential for significant gains but carries high risks due to market volatility, where losses can exceed initial investments. Effective risk management is crucial to unlock wealth within while navigating the dynamic financial landscape.

“Unleash Your Financial Potential: Mastering Leveraged Trading in Perth

Discover the art of leveraged trading and unlock wealth within! This comprehensive guide will transform your understanding of financial markets. We’ll demystify this advanced strategy, offering insights into its definition, benefits, and risks.

Explore how leveraged trading differs from traditional approaches and learn effective strategies to succeed in Perth’s dynamic market. From practical tools to inspiring case studies, we equip you with the knowledge to navigate this powerful tool for wealth creation.”

Understanding Leverage Trading:

Leveraged trading, often associated with financial markets, is a strategy that involves using borrowed funds to increase potential returns on investments. It’s a powerful tool that can amplify both gains and losses, making it a double-edged sword. By leveraging, traders aim to maximize their wealth within the market, allowing them to control larger positions with a relatively small amount of capital. This technique is particularly appealing for those seeking to grow their assets quickly, as it offers the prospect of significant gains in a short time.

However, understanding leveraged trading’s complexities is essential. It requires careful risk management due to its high potential for substantial losses. Traders must have a solid grasp of market dynamics and be prepared for volatile price movements. With proper knowledge and discipline, leveraging can become a game-changer, enabling investors to unlock the full potential of their wealth within the dynamic financial landscape.

– Definition and basic concept

Leveraged trading, a powerful strategy for amplifying potential returns, involves utilizing borrowed funds to increase buying power and maximize gains in financial markets. This concept is based on the idea of ‘leverage’, where investors can control a more substantial position than their initial investment allows. By borrowing money from brokers, traders can multiply their purchasing capacity, enabling them to capitalize on market movements with greater force.

The basic principle behind leveraged trading is to borrow funds at a certain interest rate and use them to trade assets like stocks, commodities, or currencies. If the market moves in the intended direction, the profits can be substantial, potentially leading to significant wealth within a shorter time frame. However, this strategy also carries higher risks since losses can exceed the original investment, resulting in potential financial exposure if the market turns against the trader’s position.

Leveraged trading can be a powerful tool for growing your financial wealth, but it’s crucial to fully understand the risks involved. By grasping the basic concepts and employing strategic practices, you can navigate this dynamic approach to investing with confidence. Remember, while leveraged trading offers the potential for significant gains, it also demands careful management and discipline. Embrace continuous learning, stay informed, and always prioritize risk management to harness the full potential of this method and work towards achieving your financial aspirations within a secure framework.