Leverage trading offers significant investment returns but comes with heightened risks due to borrowed funds. Traders must manage margin calls, understand amplified market movements and account balance fluctuations, and implement robust risk management strategies. This includes setting risk tolerance levels, using stop-loss orders, diversifying investments, monitoring market dynamics, and making timely adjustments. A multi-faceted approach combining these elements mitigates dangers while maximizing gains in leverage trading.

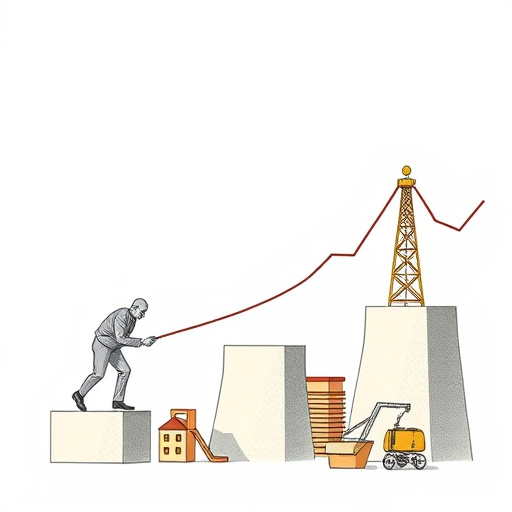

Leverage trading, a powerful tool in financial markets, offers the potential for significant gains but also carries substantial risks. As traders seek to maximize profits, understanding and managing these risks is crucial. This article delves into the intricacies of leverage trading, exploring its potential pitfalls and providing a comprehensive guide to effective risk management strategies. From identifying risk factors to employing tools for mitigation, we equip readers with essential knowledge to navigate this complex landscape successfully.

- Understanding Leverage Trading and Its Potential Risks

- Implementing Effective Risk Management Strategies

- Tools and Techniques for Mitigating Leverage Trading Dangers

Understanding Leverage Trading and Its Potential Risks

Leverage trading involves using borrowed funds to increase potential returns on investments. While it offers the opportunity for significant gains, it also carries substantial risks. The more leverage a trader uses, the higher the potential profit, but likewise, the greater the possible loss. This delicate balance requires careful consideration and a thorough understanding of market dynamics.

Traders must be cognizant of the impact of margin calls, where changes in market conditions can lead to an unexpected requirement to deposit additional funds to maintain open positions. Additionally, leverage amplifies both gains and losses, meaning small price movements can result in substantial percentage changes to a trader’s account balance. Therefore, effective risk management strategies are crucial to protect against potential financial setbacks and ensure sustainable trading success.

Implementing Effective Risk Management Strategies

In the high-stakes world of leverage trading, effective risk management is not just beneficial—it’s imperative. It involves a multifaceted approach that starts with defining clear risk tolerance levels and setting stop-loss orders to mitigate potential losses. These foundational strategies are crucial in navigating the volatile markets associated with leverage trading.

Diversification plays a significant role, too. Spreading investments across various assets and sectors can reduce the impact of any single loss. Additionally, regular monitoring and adjustments to positions based on market dynamics ensure that risk management remains proactive rather than reactive. This disciplined approach allows traders to maximize gains while keeping potential downturns in check, thereby enhancing overall success in leverage trading.

Tools and Techniques for Mitigating Leverage Trading Dangers

Leverage trading, while offering significant potential gains, also comes with heightened risks. To navigate these dangers effectively, traders should employ a combination of tools and techniques. One crucial tool is stop-loss orders, which automatically trigger the sale of an asset when it reaches a predefined price, limiting potential losses. Additionally, position sizing strategies, such as the risk-reward ratio method, help determine appropriate investment amounts based on anticipated gains and possible setbacks.

Diversification is another effective strategy. Spreading investments across multiple assets or markets reduces the impact of any single loss. Moreover, leveraging technology like advanced charting software and real-time market data enables traders to make informed decisions quickly. Regular risk assessments and adjusting trading strategies accordingly are also vital. This proactive approach ensures that traders remain in control, making leverage trading a more manageable and potentially rewarding endeavor.

Leverage trading presents a compelling opportunity for significant gains, but it’s crucial to grasp its inherent risks. By implementing robust risk management strategies and utilizing specialized tools, traders can navigate this dynamic market with confidence. Embracing these practices ensures that the potential benefits of leverage trading are realized while minimizing exposure to dangerous volatility.